dallas texas auto sales tax rate

Nys Auto Sales Tax Rate in Dallas TX. Depending on local municipalities the total tax rate can be as high as 825.

Texas Car Sales Tax What You Need To Know 2022 Getjerry Com

To calculate the sales tax on your vehicle find the total sales tax fee for the city.

. This is the total of state county and city sales tax rates. Fast Easy Tax Solutions. Dallas TX 75202 Telephone.

Dallas texas auto sales tax rate Friday February 18 2022 Edit. El Paso TX Sales Tax Rate. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas.

The Texas sales tax rate is currently. The current total local sales tax rate in Dallas TX is 8250. The Dallas sales tax rate is.

What is the local sales tax rate in Texas. Toggle navigation DCTO Left Menu. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

Some dealerships may charge a documentary fee of 125 dollars. Texass sales tax rates for commonly exempted categories are listed below. You can print a 825 sales tax table here.

The Dallas Texas sales tax is 625 the same as the Texas state sales tax. The state sales tax rate in Texas TX is currently 625. Records Building 500 Elm Street Suite 3300 Dallas TX 75202.

You are going to pay 206250 in taxes on this vehicle. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. The current total local sales tax rate in Dallas TX is 8250.

Motor Vehicle FAQs. Name A - Z Sponsored Links. Dallas Details Dallas TX is.

There is no applicable county tax. For private-party purchases of used motor vehicles in Texas. The minimum is 625 in Texas.

Wayfair Inc affect Texas. If you purchased the car in a private sale you may be taxed on the. Dallas TX Sales Tax Rate.

New Car Dealers Used Car Dealers 1 BBB Rating. The December 2020 total local sales tax rate was also 8250. The County sales tax rate is.

Fort Worth TX. Both new and established Texas residents are required by the Texas Comptroller to pay a use tax that is imposed on the total of the sales tax for the vehicle transaction. Rates include state county and city taxes.

After you enter those into the blanks you will get the Dallas City Tax which is 01. The 2018 United States Supreme Court decision in South Dakota v. The Texas Comptroller states that payment of motor vehicle sales.

This is the total of state and county sales tax rates. Vehicle Wraps In Dallas Tx And Dfw Car Wrap Van Wrap Truck Graphics Https Www Pontarelliischicago Com Chicago Limousine Service Pontarelli Chicago Limousine Services Offer Exceptional Groun Service Trip Places To Visit Art. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

The sales tax for cars in Texas is 625 of the final sales price. The selling dealers signature on the title application is an acceptable record of the sales price. Ad Find Out Sales Tax Rates For Free.

The Texas state sales tax rate is currently. Did South Dakota v. You trade-in a vehicle for 3000 and get an.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. The Dallas County sales tax rate is. The use tax rate for the sale of a car in Texas is currently 625 of the price of the car for the 2023 calendar year.

You can find these fees further down on. 1808 S Haskell Ave. Denton TX Sales Tax Rate.

Add this to the Dallas MTA tax at 01 and the state sales tax of 0625 combined together give you a tax rate of 0825. The latest sales tax rates for cities in Texas TX state. Multiply the vehicle price after trade-in andor incentives by the sales tax fee.

2020 rates included for use while preparing your income tax deduction. Corpus Christi TX Sales Tax Rate. 214 653-7888 Se Habla Español.

For example imagine you are purchasing a vehicle for 35000 with the state sales tax of 625. YEARS IN BUSINESS 214 826-5953. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

Clive Tarrant county tax assessor-collectors office Collect sales tax Texas tx state. If you are buying a car for 2500000 multiply by 1 and then multiply by 0825. 214 653-7811 Fax.

What is the sales tax rate in Dallas County. The minimum combined 2022 sales tax rate for Dallas Texas is. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

The minimum combined 2022 sales tax rate for Dallas County Texas is. For tax rates in other cities see Texas sales taxes by city and county. We urge our customers to take advantage of processing their Motor Vehicle Transactions and Property Tax Payments online at this website.

Some rates might be different in. What is the sales tax rate in Dallas Texas. The CTAC can however request to see the dealers invoice or sales receipt from the dealer or purchaser.

See reviews photos directions phone numbers and more for Nys Auto Sales Tax Rate locations in Dallas TX.

New Bmw Cars Savs For Sale In Dallas Tx New Inventory

Used Car Dealer In Dallas Tx 75232 Drivetime

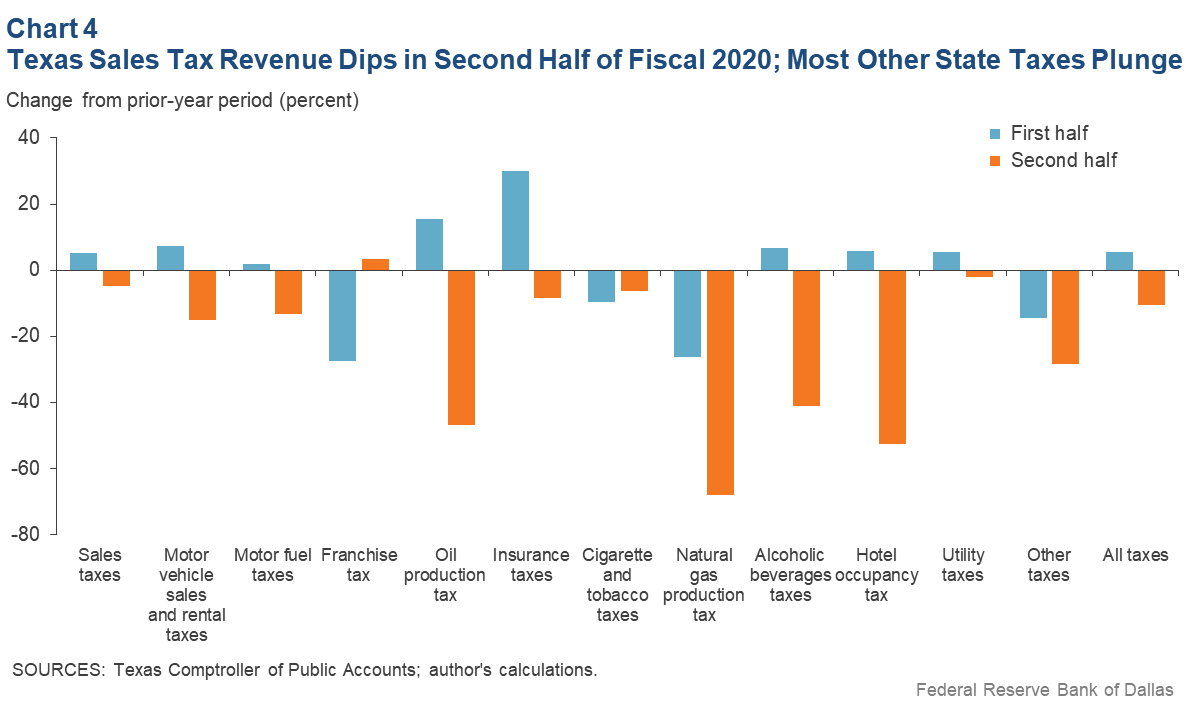

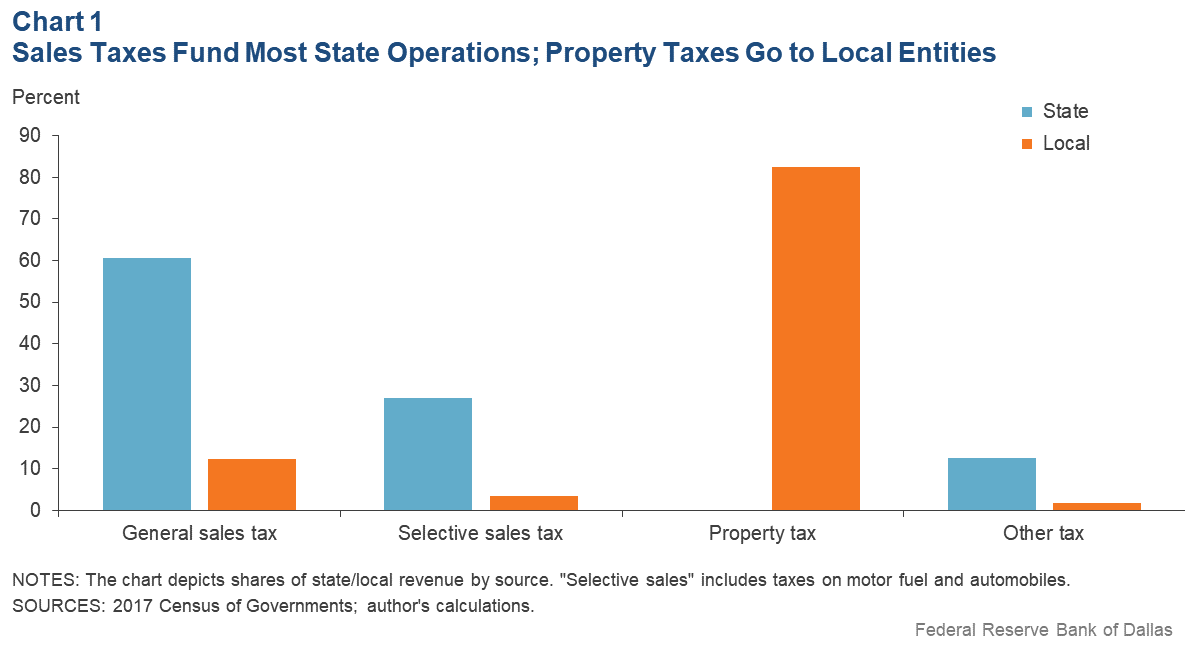

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

9696 Skillman St Dallas Tx 75243 Dallas Value Add Office Loopnet

Defying National Trend Violent Crime In Dallas Is Down Bloomberg

Texas Used Car Sales Tax And Fees

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/UCF3YRRNCTLAE3LNBBXQML2BWM.jpg)

Meet The Dallas Petrolhead Who Bought Texas First 3 Million Bugatti Chiron For His Father

Texas Car Sales Tax What You Need To Know 2022 Getjerry Com

Texas Car Sales Tax What You Need To Know 2022 Getjerry Com

Days Inn By Wyndham Market Center Dallas Love Field Dallas Tx Hotels

Used Cars In Dallas Tx For Sale Enterprise Car Sales

Which U S States Charge Property Taxes For Cars Mansion Global

Texas Car Sales Tax Everything You Need To Know

Registration Fees Penalties And Tax Rates Texas

How Much Is It To Own A Car In Texas Learn About Running Car Costs

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org